Pre-Qualification

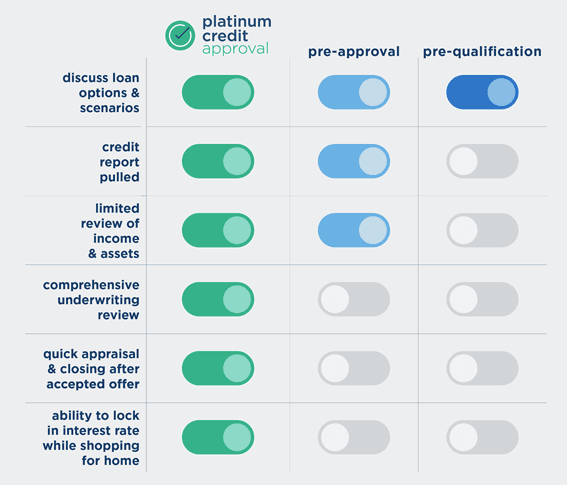

Pre-qualification is an informal process where a homebuyer provides their potential lender with some basic information, such as their current income and debt levels. Then, the lender calculates an estimated mortgage loan amount that the homebuyer may qualify for. The key word here is: informal. While a pre-qualification can be helpful at the beginning of your mortgage journey, it’s a very high-level, general estimate. To get a more accurate picture of what you can afford, a pre-approval or a PCA are better options.

Pre-Approval

A pre-approval has a more formalized process than a pre-qualification. If you’re hoping to buy a home and are ready to get pre-approved for a mortgage, we’ll ask you to provide supporting documents such as recent paycheck stubs and bank statements. We’ll also pull and review your credit report. Then, an Automated Underwriting System (AUS), along with our underwriting team, will determine your eligibility. Your Waterstone Mortgage loan originator will review the information in more detail to approve or deny a loan amount.

Platinum Credit Approval

A Platinum Credit Approval (PCA) is the most formal version of the pre-approval process, and it will give you the most accurate picture of the loan amount you may qualify for. To receive a Platinum Credit Approval, you will complete the same steps needed for a traditional pre-approval. In addition, our underwriting team will complete an in-depth analysis of your credit, financial, and employment information. After you make an offer on a property and it’s accepted, you’re well on your way! An appraisal of the property will be completed and — as long as all conditions for the home and the loan are met — a quick closing follows.

Platinum Credit Approval Closing Guarantee

The Waterstone Mortgage Platinum Credit Approval Closing Guarantee combines the strong assurance of our Platinum Credit Approval with the security of a closing guarantee — providing the peace of mind that buyers and sellers seek in an ever-changing, competitive market.

Waterstone Mortgage proudly stands behind our Platinum Credit Approval process. With our new Platinum Credit Approval Closing Guarantee, if we are unable to close a Platinum Credit Approval loan — due to an internal error during our underwriting process — we will pay the seller(s) of the subject property $5,000.*